KEY PROFIT DRIVERS – PASTURE SYSTEM

Presentation to South African Large Herds Conference - February 2005

By David Beca

SUMMARY

There are 5 key profit drivers in pasture based dairying. These include:

1. Pasture harvest measured as “tonnes of pasture dry matter harvested per hectare”

2. Milk production measured as “milk produced per hectare”

3. Supplementary feed cost measured as “forage cost per tonne dry matter consumed” and “concentrate cost per tonne dry matter consumed”

4. Labour efficiency measured as “cows milked per full time staff equivalent”

5. Base cost structure measured as “gross expenses per cow excluding supplementary feed and nitrogen”

Milk production (point 2 above) has the highest capacity to be misinterpreted. This is due to there being a “tipping point” where increased levels of milk production will result in firstly a higher level of risk and then secondly a reduction in profit. These two “tipping points” occur at different points on the milk production curve.

There are no key profit ratios in pasture based dairying that can refer to milk e.g. per litre, per milkfat, per milksolids. This is due to the issue outlined in the paragraph above and due to profit ratios needing to refer to a return on capital (i.e. land, cows). Ratios that refer to milk should be considered as assessments of risk only.

Farm size is not a key profit driver due to the high proportion of variable costs associated with pasture based dairying. The low proportion of fixed costs only disadvantages the very small farms.

DEFINING TERMS FOR ASSESSING PROFIT

To undertake a discussion on key profit drivers there must be an agreement on how profit is determined. Profit can be defined as the return received on the capital invested in a business. By this definition any profit ratio should refer to capital (e.g. monetary value of investment, land, or cows). By this definition any ratio that refers to milk cannot be a direct profit ratio, although it is likely to be a risk ratio that in some form indicates the level of risk to receiving a predetermined profit.

Return on Capital (‘ROC’) is considered the most complete assessment of business profit. This is calculated by dividing Operating Profit by the full value of assets employed in the business (both owned and leased). ‘Operating Profit’ = Revenue less Expenses plus/minus Adjustments to Revenue and Expenses. These Adjustments would include differences between opening and closing livestock and feed on hand, as well as adjustments to expenses that have been included in the accounts but have multiple year benefits (i.e. applications of capital fertiliser or farm development expenses included under repairs and maintenance need to be nominally capitalised and depreciated over a number of years). An imputed value for owner’s management and time must also be included where a direct salary is not taken from the business. Depreciation is included. All financing/debt servicing costs and tax are excluded.

There are further definitions of the following key performance indicators in Appendix I:

§ Return on Assets (‘ROA’)

§ Operating Profit per Hectare

§ Pasture Harvest per Hectare (tDM/ha = tonne dry matter per hectare)

§ Operating Profit Margin

§ Pasture as Percentage of Total Feed Consumed

§ Milk Production per Hectare

§ Forage/Concentrate Cost (Per tDM Consumed including Wastage)

§ Cows Milked per Full Time Staff Equivalent

§ Base Cost Structure ($/cow)

§ Peak Cow Numbers

1ST KEY PROFIT DRIVER – PASTURE HARVEST

In almost all instances pasture is the lowest cost feed in pasture based dairying. In Australia and New Zealand the direct (‘purchase’) cost of pasture is most often $25-$50 per tonne dry matter. Although variable and capital costs most often boost this cost to $110-$190/tDM, this is usually significantly lower that the cost of any supplementary feed.

TABLE 1: Comparative Cost of Pasture vs Forages vs Concentrates (Australia)

|

FEED |

Split |

Top 67% |

Top 10% |

Top 2% |

|

Pasture Cost ($/tDM) |

Direct Cost |

$35-$45 |

$25-$35 |

$20-$30 |

|

Full cost |

$140-$170 |

$120-$140 |

$100-$120 |

|

|

Forage Cost ($/tDM) |

Purchase Cost |

$110-$130 |

$90-$120 |

$90-$120 |

|

Full cost |

$160-$200 |

$140-$180 |

$140-$180 |

|

|

Concentrate Cost ($/tDM) |

Purchase Cost |

$200-$230 |

$200-$230 |

$200-$230 |

|

Full cost |

$220-$260 |

$220-$260 |

$220-$260 |

The value of pasture is heavily influenced by the amount of pasture harvested per hectare and as a result the most significant outcome of increasing pasture harvest is to drive down the cost of pasture and therefore the average cost of production. This principle supports the outcome of most recognised studies of pasture based dairying, namely that there is a positive correlation between increasing pasture harvest and increasing profitability.

2ND KEY PROFIT DRIVER – MILK PRODUCTION PER HECTARE

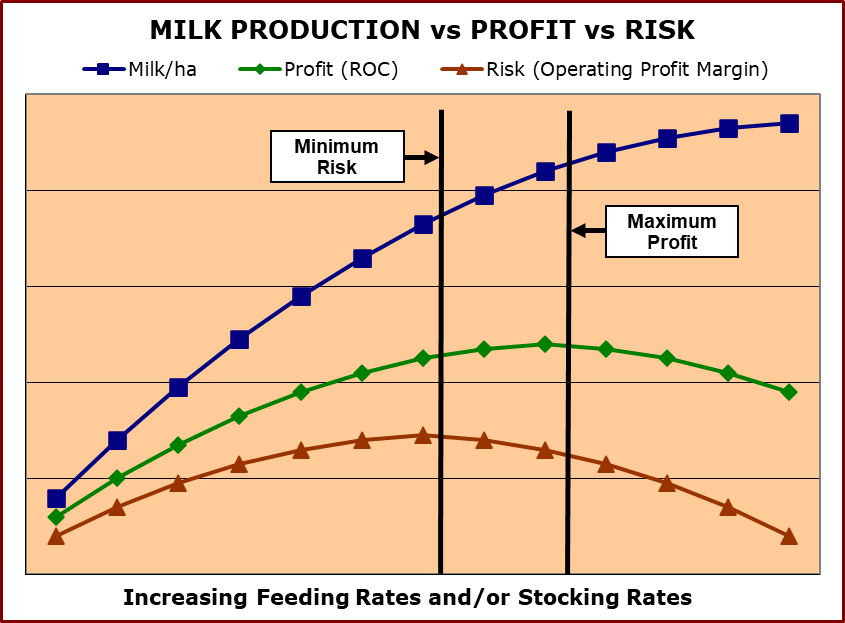

Increasing supplementary feeding rates to cows and/or increasing stocking rate generally lead to an increase in milk production per hectare. The response curve is curvilinear so that increasing milk production per hectare by these means generally lead to a strong positive correlation to profit when imposed on a low level of performance. At moderate levels of milk production per hectare the correlation to profit is weak, and at high levels of milk production per hectare the correlation will at some point become negative. As a result there is a “tipping point” where further increases to milk production per hectare will result in a reduction in profit.

The risk profile moves in a similar pattern with increases in milk production per hectare. However the “tipping point” where risk begins to increase with lifts in milk production occurs at a lower point on the milk production per hectare curve than is the case with profit.

As Graph 1 below shows, this leads to very different points where milk production, profitability and risk are optimised, and is the reason why the relationship between milk production and profit is often misinterpreted.

It is also important to understand that both the shape of these curves and the “tipping points” for profit and risk are farm specific. The key determinants of the shape of these curves are milk price, pasture production (or price), supplementary feed price and base cost structure.

GRAPH 1: Relationship between Milk Production, Profit and Risk

* Risk = Operating Profit Margin, therefore Higher figure = Lower risk

3RD KEY PROFIT DRIVER – SUPPLEMENTARY FEED COST

Although it is important to understand the role of nutrition and the effect of the varying composition of feeds to cow performance, the primary influence of supplementary feed on profit is the cost of these forages and concentrates. As with pasture this includes the purchase price (which should include any storage costs) plus the variable costs and capital costs. In addition the effects of wastage must be quantified, including both storage/bunker wastages and losses in delivery of the feed to the cows.

The impact of these additional costs is that the full cost of forage is usually $50-$100/tDM or 30%-50% above the purchase price. In the case of concentrates these additional costs usually result in their full cost being $20-$40/tDM or 7%-15% above the purchase price.

The most significant opportunity in pasture based dairying to reduce the cost of forages is to produce the forage on an area controlled by the business (‘home grown’ forage). Crop yield is the second major opportunity to reduce forage costs.

In the case of concentrates there is often less opportunity to produce these as home grown feeds. There can still be significant opportunities through astute purchasing decisions. In addition there are often opportunities to reduce the effective cost of concentrates through eliminating potentially excessive use of protein, minerals, trace elements and other additives.

4TH KEY PROFIT DRIVER – LABOUR EFFICIENCY

After feed costs, labour costs are normally the next largest cost centre. In pasture based dairying there are many instances where labour costs (including imputed management costs) are greater than feed costs.

Labour efficiency is significantly elastic in that there is a wide variation in performance. For instance, in both Australia and New Zealand the average level of performance is most commonly 90-110 cows per full time staff equivalent, with the top 10% of farms running 110-120 cows. However there is also a significant minority running 140-170 cows per full time equivalent which provides a window into a major opportunity for many farmers to lift profitability.

Although it may appear obvious that farms feeding higher amounts of supplement would have lower labour efficiency, it would be incorrect to assume that these farms cannot have very high levels of labour efficiency. There are a significant proportion of highly supplemented farms that appear in both the top 10% and very high performers in this area. On closer examination of these farms it might be reasonable to conclude that the most critical factor in labour efficiency is whatever is “above the neck” of the business owner/operator. Again this ensures that labour efficiency is one of the most significant opportunities for lifting profitability on pasture based dairy farms.

5th KEY PROFIT DRIVER – BASE COST STRUCTURE

The level of base costs on pasture based dairy farms often define the farm in that the control of base costs is an integral part of high profit farms. When the base costs are compared on a per cow basis, high profit farms normally have a lower cost structure than other farms even though they will often exhibit a higher level of production.

Pasture based dairying has a high proportion of variable costs in that these variable costs normally constitute 70%-85% of operating expenses. In a high variable cost business there are not significant opportunities to increase revenue (i.e. milk production) to “water down” the impact of high costs. Effectively businesses with a high proportion of variable costs have no alternative but to control costs if they are to be significantly profitable.

FARM SIZE – NOT A KEY PROFIT DRIVER

Many studies of pasture based dairy farms have noted that the higher profit farms are of a larger average size and concluded that there were economies of scale that advantaged larger farms. Interestingly studies of farm profitability in New Zealand do not show an advantage to larger farms, with the top 10% of farms just as likely to be smaller than the average group rather than larger in any one year.

Given there are only a small proportion of fixed costs in pasture based dairying (and most of these ‘fixed’ costs alter proportionately with farm size), it would be inconsistent to draw the conclusion that size of farm would provide any significant advantage. It is true that very small farms would have some disadvantages due to factors such as the impact of imputed or real management costs being spread across a small number of cows along with the fixed structural costs in dairying. However once the dairy farm is of moderate size (i.e. 150-200 cows in Australia and New Zealand) then the impact of farm size has low impact.

Once pasture based dairy farms grow past 700-800 cows there are factors that potentially negatively impact on farm profitability and erode the small advantage from size. This potential loss in performance comes from removing the key operator from the “coal face” of the cow-pasture-supplement interface and placing them more in the position of “people and financial” manager. This new position is one in which there is often a comparatively low level of familiarity and skill, while removal from the critical position at the cow-pasture-supplement interface almost inevitably leads to losses in efficiencies.

The fact that many studies do show that more profitable farms are larger than less profitable farms should be interpreted as no more than the result of profitable operators normal business behaviour, namely that they will grow their business faster than less profitable business operators.

NO KEY PROFIT DRIVERS SHOULD REFER TO MILK

There are no key profit ratios in dairying that should refer to milk e.g. per litre, per milkfat, per milksolids. In the first instance milk is not a capital item like land or cows (or the combined value of all assets) but a component of revenue. Profit ratios by definition need to refer to a unit of capital.

Secondly, in pasture based dairying milk production per hectare or per cow does not have a consistent positive correlation with profit. In fact at some point the relationship becomes negatively correlated to profit.

To potentially illustrate the error in using “per milk” ratios, take an example where a small amount of additional grain was suddenly added to a cows diet in a pasture based dairying system. If we assume that the grain was nutritionally balanced then there is a high likelihood that additional milk would be produced. This in turn would improve a host of milk ratios e.g. all non-feed costs per kg milk, milk per full time staff equivalent, etc. And yet in most cases we would have no idea whether this would have improved profitability.

As a result ratios that refer to milk should be considered as assessments of risk only. The higher proportion of each kilogram of milk being required for expenses would mean that it would require a smaller change in either milk price or some other significant factor to result in a substantial deterioration (or improvement) in business performance. Certainly ratios that refer to milk can be very effective determinants of risk.

APPENDIX I

Return on Capital (‘ROC’) is considered the most complete assessment of business profit. This is calculated by dividing Operating Profit by the full value of assets employed in the business (both owned and leased). ‘Operating Profit’ = Revenue less Expenses plus/minus Adjustments to Revenue and Expenses. These Adjustments would include differences between opening and closing livestock and feed on hand, as well as adjustments to expenses that have been included in the accounts but have multiple year benefits (i.e. applications of capital fertiliser or farm development expenses included under repairs and maintenance need to be nominally capitalised and depreciated over a number of years). An imputed value for owner’s management and time must also be included where a direct salary is not taken from the business. Depreciation is included. All financing/debt servicing costs and tax are excluded.

Return on Assets (‘ROA’) is the next most complete assessment of business profit. This is calculated in a similar fashion to ROC. The key difference is that any lease payments are deducted from Operating Profit and then this is divided by the value of owned assets employed in the business (the value of leased assets are excluded). Where there are no assets being leased then ROA equals ROC.

Operating Profit per Hectare is the next most relevant assessment of profit for a farm business where land is the largest component of asset values, as is normally the case with pasture based dairy farms. To use this measure for comparative purposes then it is essential that the farms are on land of similar productive capacity.

Pasture Harvest per Hectare (tDM/ha = tonne dry matter per hectare) is the one physical measure that appears to have a direct relationship with profitability in pasture based dairying. This should be calculated as the dry matter tonnes of consumed pasture per hectare.

Operating Profit Margin is the most relevant assessment of risk for a pasture based dairying business. This is calculated by dividing Operating Profit by Gross Revenue and records the proportion of revenue retained as profit. In most businesses Operating Profit Margin would be categorised as an efficiency measure, as it would be in non-pasture based dairying businesses. However due to the lower cost of pasture as compared to other feeds plus the economic necessity to maximise use of pasture, it is more appropriately categorised as a risk ratio.

Pasture as Percentage of Total Feed Consumed is a secondary assessment of risk for a pasture based dairying business. The inclusion of additional supplements into a pasture based dairying business will in almost all circumstances increase the average cost of feed and therefore increase the risk.

Milk Production per Hectare is an efficiency measure that has a curvilinear relationship with profit (see Graph 1). This means that at low levels of milk production per hectare there is a strong positive correlation between lifting milk production and lifting profit. At moderate levels of milk production per hectare there is a weaker positive correlation between lifting milk production and lifting profit, and at high levels of milk production per hectare there is a neutral or negative correlation between lifting milk production and lifting profit.

Forage/Concentrate Cost (Per tDM Consumed including Wastage) = (Purchased Feed Cost Variable Feed Cost Capital Feed Cost) / Weighted Average Wastage Rate. This is a complete assessment of feed costs and is a measure of how efficiently feeds are being purchased and fed to livestock. The purchased feed cost should include a storage cost where appropriate. The variable costs include an appropriate share of staff/labour costs, vehicle costs and repairs and maintenance costs. The capital costs includes depreciation on buildings/structures, vehicles, plant and machinery utilised in forage and concentrate feeding, along with an opportunity cost of capital on these assets.

Cows Milked per Full Time Staff Equivalent is an efficiency measure that records the number of cows that are being milked per standardised full time staff equivalent. This standardisation is based on weekly hours worked and in this paper this is based on a 50 hour week. The amount of contracted work being employed by individual farms (e.g. for forage harvesting, fertiliser applications, etc), as opposed to being completed by farm staff, will influence this ratio and as a result some caution should be used when interpreting it. Neither revenue nor milk produced per full time staff equivalent can be used as an efficiency ratio due to the degree to which these ratios can be influenced by higher levels of feeding without any significant correlation to profit.

Base Cost Structure ($/cow) = All expenses after adjustments for capitalised expenses and feed on hand, including depreciation and imputed management costs but excluding purchased feed costs and nitrogen divided by peak cow numbers. This efficiency measure determines the underlying cost structure of a pasture based dairy business after removing the major cost centres influenced by different farming systems.

Peak Cow Numbers = this is the number of milking cows that completed at least 3 months of a lactation and is the figure that is used for all Per Cow comparisons. In a seasonal supply farm this will often be the peak total number of milking cows that were milked for a minimum of 4-6 weeks. In a split calving or all-year round calving regime this figure will often be 10%-20% higher than the rolling herd average figure.